The Internet Transit market and the gravitational pull to $0/Mbps.

last updated August 2010

Internet Transit is a simple way to get connected to the Internet.

Definition: Internet Transit is the business relationship whereby one ISP provides (usually sells) access to all destinations in its routing table .

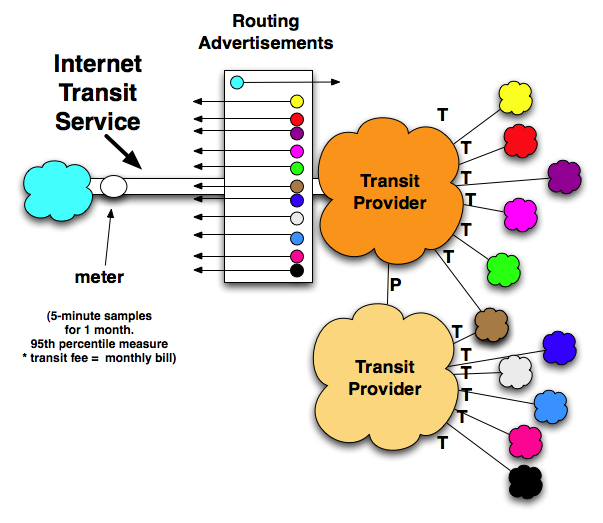

Figure - Transit Relationship - selling access to the entire Internet.

Internet Transit can be thought of as a pipe in the wall that says "Internet this way".

In the illustration above, the Cyan ISP purchases transit from the Orange Transit Provider (sometimes called the "Upstream ISP"), who announces to the Cyan ISP reachability to the entire Internet (shown as many colored networks to the right of the Transit Providers). At the same time, the Transit Provider propagates the Cyan routes across the Internet so that all attached networks know to send packets to the Cyan ISP through the Orange Transit Provider. In this way, all Internet attachments know how to reach the Cyan ISP, and the Cyan ISP knows how to get to all the Internet routes.

Some Characteristics of Internet Transit

Transit is a simple service from the customer perspective. All one needs to do is pay for the Internet Transit service and all traffic sent to the upstream ISP is delivered to the Internet. The transit provider charges on a metered basis, measured on a per-Megabit-per-second basis using the 95th percentile measurement method.

Transit provides a Customer-Supplier Relationship. Some content providers shared with the author that they prefer a transit service (paying customer) relationship with ISPs for business reasons as well. They argue that they will get better service with a paid relationship than with any free or bartered relationship. They believe that the threat of lost revenue is greater than the threat of terminating a peering arrangement if performance of the interconnection is inadequate.

Transit may have SLAs. Service Level Agreement and rigorous contracts with financial penalties for failure to meet service levels may feel comforting but are widely dismissed by the ISPs that we spoke with as merely insurance policies. The ISPs said that it is common practice to simply price the service higher with SLAs, with increased pricing proportional to the liklihood of their failure to meet these requirements. Then the customer has to notice, file for the SLA credits, and check to see that they are indeed applied. There are many ways for SLAs to simply increase margins for the ISPs without needing to improve the service.

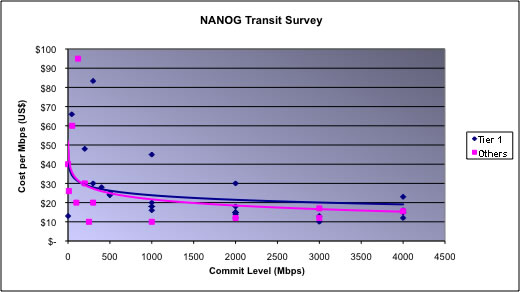

Transit Commits and Discounts. Upstream ISPs often provide volume discounts based on negotiated commit levels. Thus, if you commit to 10Gigabits-per-second of transit per month, you will likely get a better unit price than if you commit to only 1gigabit-per-second of transit per month. However, you are on the hook for (at least) the commit level worth of transit regardless of how much traffic you send.

Transit is a commodity. There is debate within the community on the differences between transit from a low cost provider and the Internet transit service delivered from a higher priced provider. The higher price providers argure that they have better quality equipment (routers vs. switches)

Transit is a metered Service. The more you send or receive, the more you pay. (There are other models such as all-you-can-eat, flat monthly rate plans, unmetered with bandwidth caps, etc. but at the scale of networking where Internet Peering makes sense the Internet Transit services are metered.)

You simply pay a metered rate for your traffic to be delivered to the Internet and for your network to be announced as reachable across the Internet. Since the commercialization of the Internet, Internet Transit prices have declined every year as this article will discuss.

In this report we document the U.S. Internet Transit market's twelve year quest towards $0/Mbps pricing.

Since 1998, DrPeering has been tracking the commodity U.S. Internet Transit pricing.

The method for data collection is informal, mostly based on discussions at Internet Operations Forums from 1998 to 2010. It is important to note a few things about these informal surveys:

Every year, everyone believed that the Internet Transit pricing drops could not possibly continue. And yet the gravitational forces pulling transit prices downward appears to be a natural law.

"No one can make money at $___ /Mbps" and "the pricing has to level off now" they said. Yet every year the pricing dropped again. As you will see in the data below, it is not a good time to be in the Internet Transit market as a supplier.

| Year | Internet Transit Prices (in Mbps, min commit) | % Decline | |

|---|---|---|---|

1998 |

$1200 |

per Mbps | |

| 1999 | $800 |

per Mbps | 33% |

| 2000 | $675 |

per Mbps | 16% |

| 2001 | $400 |

per Mbps | 40% |

| 2002 | $200 |

per Mbps | 50% |

| 2003 | $120 |

per Mbps | 40% |

| 2004 | $90 |

per Mbps | 25% |

| 2005 | $75 |

per Mbps | 17% |

| 2006 | $50 |

per Mbps | 33% |

| 2007 | $25 |

per Mbps | 50% |

| 2008 | $12 |

per Mbps | 52% |

| 2009 | $9.00 |

per Mbps | 25% |

| 2010 | $5.00 |

per Mbps | 44% |

| 2011 | $3.25 |

per Mbps | 35% |

| 2012 | $2.34 |

per Mbps | 28% |

| 2013 | $1.57 |

per Mbps | 33% |

| 2014 | $0.94 |

per Mbps | 40% |

| 2015 | $0.63 |

per Mbps | 33% |

| Source: DrPeering.net | |||

The unmistakable Transit Pricing trend is down, with an average decline of 61% from 1998 to 2010 as shown in the graph below.

U.S Internet Region

Content Delivery Network pricing is following the same downward price trend, and tends to be priced at approximately the same price point as Internet Transit. One implication of this is that the CDNs that don't run their own backbones (such as Akamai) may fare better than those who do run their own backbone (Limelight Networks) since Akamai is able to purchase transit at increasing volumes and at ever decreasing costs. (Transport prices tend to drop at a lower rate.)

Dan Rayburn shared CDN pricing information on CDNs that showed pretty amazingly low pricing trajectories ($0.02-$0.06 per GB for 500TB commits) approximately in line with our estimates.

So here we take a stab a projecting the future - predictions of this type are merely for discussion purposes.

The Transit and CDN Markets are doomed. The days of simple Internet Transit or vanilla CDN services are numbered; and any business model that is based on margins on something going to zero are doomed.

The Peering Sector will morph in two ways to serve the large (video scale) peers. Since Internet Peering is an alternative to simply sending your traffic through Internet Transit services, the question, as always, is "Does Peering Make Sense Anymore?" The answer will be YES, but for a different market than today.

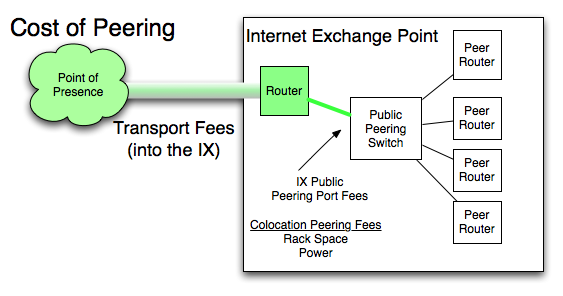

With Internet Transit Pricing dropping so fast, peering using Public Peering ports will become very difficult to justify financially, and the volume of traffic between bilateral peers will exceed the amount that is reasonable to do over public public ports.

To illustrate, let's do some simple calculations and see how this plays out given our transit pricing history and predictions data.

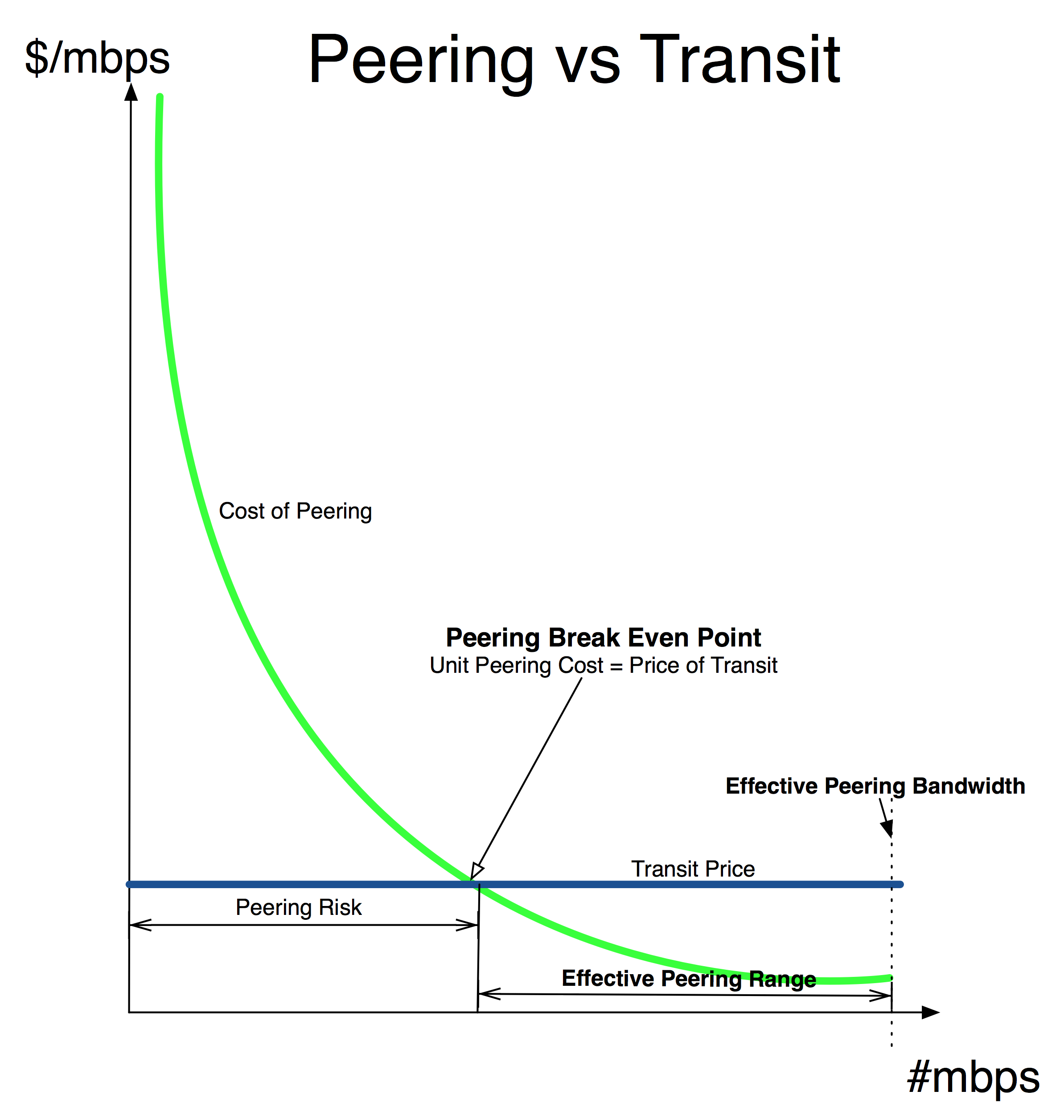

If you assume the cost of public peering is $10,000/month ($2500 for a 10G public peering port and $7500 for colo, power, transport, equipment, etc.), you see that in 2010, peering makes sense financially if you can peer away at least 2Gbps (2000Mbps) for free to your peers. This gives you plenty of breathing room to peer traffic away for less than the price of transit, up to 7.6Gbps (7600Mbps), which is approximately the amount of traffic one can reasonably sustain over a 10G peering port. But this is for 2010 with an average transit price of $5/Mbps.

| Year | Transit Price (per Mbps) | Peering Cost (per month) | Peering Break Even Point | Effective Peering Bandwidth (w/10G port) | |

| 2008 | $12.00 | $10,000 | 833 | Mbps | up to 7600Mbps |

| 2009 | $9.00 | $10,000 | 1111 | Mbps | up to 7600Mbps |

| 2010 | $5.00 | $10,000 | 2000 | Mbps | up to 7600Mbps |

| 2011 | $3.25 | $10,000 | 3077 | Mbps | up to 7600Mbps |

| 2012 | $2.34 | $10,000 | 4274 | Mbps | up to 7600Mbps |

| 2013 | $1.57 | $10,000 | 6369 | Mbps | up to 7600Mbps |

| 2014 | $0.94 | $10,000 | 10638 | Mbps | up to 7600Mbps |

| 2015 | $0.63 | $10,000 | 15873 | Mbps | up to 7600Mbps |

With these pricing estimates we see that in 2012, peering still makes sense, but with an average Internet Transit price of $2.34/Mbps, we see a Peering Break Even point of 4274Mbps where peering begins to make sense. Beyond this point, peering makes sense financially up to 7.6Gbps, the Effective Peering Bandwidth of the pipe.

Definition: The Peering Break Even Point is the point where the unit cost of peering exactly equals the unit cost for transit.

Definition: Effective Peering Bandwidth refers to the maximum usable bandwidth available for peering traffic, taking into account framing and burstability. As peers approach the Effective Peering Bandwidth, they will generally need to upgrade the interconnect.

This is not much of an Effective Peering Range; getting peering traffic volumes to fit in this range is tricky, so peering folks will mostly likely not go forward with public peering (all things remaining equal).

Definition: Effective Peering Range refers to the range of traffic exchange from the Peering Break Even Point to the Effective Peering Bandwidth along the peering path. This is the range of traffic exchange where peering provably makes sense financially.

As fewer and fewer ISPs publicly peer, the rationale for public peering to aggregate smaller peering sessions together over a public peering fabric diminishes. And the technology is not well suited today to handle massive peering sessions over public peering fabrics.

As a result, we will make the prediction that Private Peering will dominate the peering ecosystem in the U.S. by 2012. Point-to-point fiber is just too cost effective, reliable, and ease to deploy to compete with.

The sector will morph to serve primarily three classes of IX customer over the next few years:

There is simply no margin in Internet Transit services. There had better be some form of premium or bundled services to offer on top of transit services to provide some profit margins. ISPs then act like a convenience store that offers milk below cost so that customers buy the other items in the store while you are there.

Never before has there been such an opportunity for the Access Networks (those who connect the eyeballs to the Internet) to charge a little more to content companies for enhanced access to the eyeballs. Paid Peering for content providers, embedding services for content, selling services within the last mile, are all examples of premium access services that could be sold to content who will pay for them. If you are a CDN and your competitors are embedded in the last mile networks, you pretty much have no choice but to purchase the same level of access just to compete.

A wise man named Hank told me "The Internet industry pathology is that dollars are not flowing through the supply chain."

In order to deal with the loss of margin on the transit services, ISPs may join forces in the form of cooperative initiatives to enable the sale of premium Internet services via an overlay network supported by the InterStream, ETICs, etc. or other industry-specific cooperative VPN services such as the old ANX (Automotive Network Exchange) promote. The power in these initiatives come from the unique services provided for customers from these cooperative network services. Our work with large carriers suggests a 30% premium could be realized solely by offering end-to-end cross AS boundary services.

With a cross-AS cooperative CDN service for example, all ISPs across a supply chain may reap the portion of the incremental revenue that large video streamers are willing to pay for a better end-user experience. This would disseminate the CDN revenue across those who distribute the bits, not just those who peer those bits away from a disk at a peering point to an access network. This is one example where ISPs who cooperate in such end-to-end services can offer services at a premium that other ISPs simply can not provide.

The author was invited as part of a team brought together by a large Venture Capital firm in Silicon Valley. The challenge on the table -

"Design a business model for a CDN that prospers when the price for distribution $0/Mbps".

It was an interesting exercise, and the conclusions we reached were that CDN revenue will be derived from new sources:

1) The value is not in the bits, it is in the data surrounding the consumption. Consider a new Hollywood sitcom that does a preliminary test run in an Internet test market before they go into full production. When do consumers turn off the show - how far in before they give up on the pilot? Refining the formula and running again is possible with different groups within a test market. Do we have the winning formula for the show? That is critical information to the content producer, one that increases the chances of their success and, yes, something they are willing to pay for. What is missing is the business model and the technology.

2) The value will be in the add-ons - getting the bits there is not enough - some indication of the reliability, some guarantee for the quality of the streams delivered, having instrumentation and control panels that meet the enhanced needs of these large video pushers continues to determine who wins the business. The services that are built on top of the commodity transit will be the ones to charge for - transit is the milk that is priced low to get people into the convenience mart.

3) Taking a piece of the value - cooperative and revenue participation based service offerings will allow the content distributed at $0Mbps and pay out when the clicks, purchases, etc. are made.

![]()

DrPeering@DrPeering.net

Index of other white papers on peering

WIlliam B. Norton is the author of The Internet Peering Playbook: Connecting to the Core of the Internet, a highly sought after public speaker, and an international recognized expert on Internet Peering. He is currently employed as the Chief Strategy Officer and VP of Business Development for IIX, a peering solutions provider. He also maintains his position as Executive Director for DrPeering.net, a leading Internet Peering portal. With over twenty years of experience in the Internet operations arena, Mr. Norton focuses his attention on sharing his knowledge with the broader community in the form of presentations, Internet white papers, and most recently, in book form.

From 1998-2008, Mr. Norton’s title was Co-Founder and Chief Technical Liaison for Equinix, a global Internet data center and colocation provider. From startup to IPO and until 2008 when the market cap for Equinix was $3.6B, Mr. Norton spent 90% of his time working closely with the peering coordinator community. As an established thought leader, his focus was on building a critical mass of carriers, ISPs and content providers. At the same time, he documented the core values that Internet Peering provides, specifically, the Peering Break-Even Point and Estimating the Value of an Internet Exchange.

To this end, he created the white paper process, identifying interesting and important Internet Peering operations topics, and documenting what he learned from the peering community. He published and presented his research white papers in over 100 international operations and research forums. These activities helped establish the relationships necessary to attract the set of Tier 1 ISPs, Tier 2 ISPs, Cable Companies, and Content Providers necessary for a healthy Internet Exchange Point ecosystem.

Mr. Norton developed the first business plan for the North American Network Operator's Group (NANOG), the Operations forum for the North American Internet. He was chair of NANOG from May 1995 to June 1998 and was elected to the first NANOG Steering Committee post-NANOG revolution.

William B. Norton received his Computer Science degree from State University of New York Potsdam in 1986 and his MBA from the Michigan Business School in 1998.

Read his monthly newsletter: http://Ask.DrPeering.net or e-mail: wbn (at) TheCoreOfTheInter (dot) net

Click here for Industry Leadership and a reference list of public speaking engagements and here for a complete list of authored documents

The Peering White Papers are based on conversations with hundreds of Peering Coordinators and have gone through a validation process involving walking through the papers with hundreds of Peering Coordinators in public and private sessions.

While the price points cited in these papers are volatile and therefore out-of-date almost immediately, the definitions, the concepts and the logic remains valid.

If you have questions or comments, or would like a walk through any of the paper, please feel free to send email to consultants at DrPeering dot net

Please provide us with feedback on this white paper. Did you find it helpful? Were there errors or suggestions? Please tell us what you think using the form below.

Contact us by calling +1.650-614-5135 or sending e-mail to info (at) DrPeering.net